Table of Contents

Introduction

If you’ve been injured on the job no insurance, understanding your rights and the immediate steps to take is crucial. When workplace injuries occur and there’s a lack of proper insurance coverage, it can lead to uncertainty and stress about handling medical expenses and potential lost wages. This guide is designed to provide you with a straightforward path forward.

Firstly, know that your situation, although challenging, has solutions. Depending on the specifics, you might have the option to seek compensation through legal claims, negotiate medical costs, or apply for government assistance. The key is to act quickly and knowledgeably.

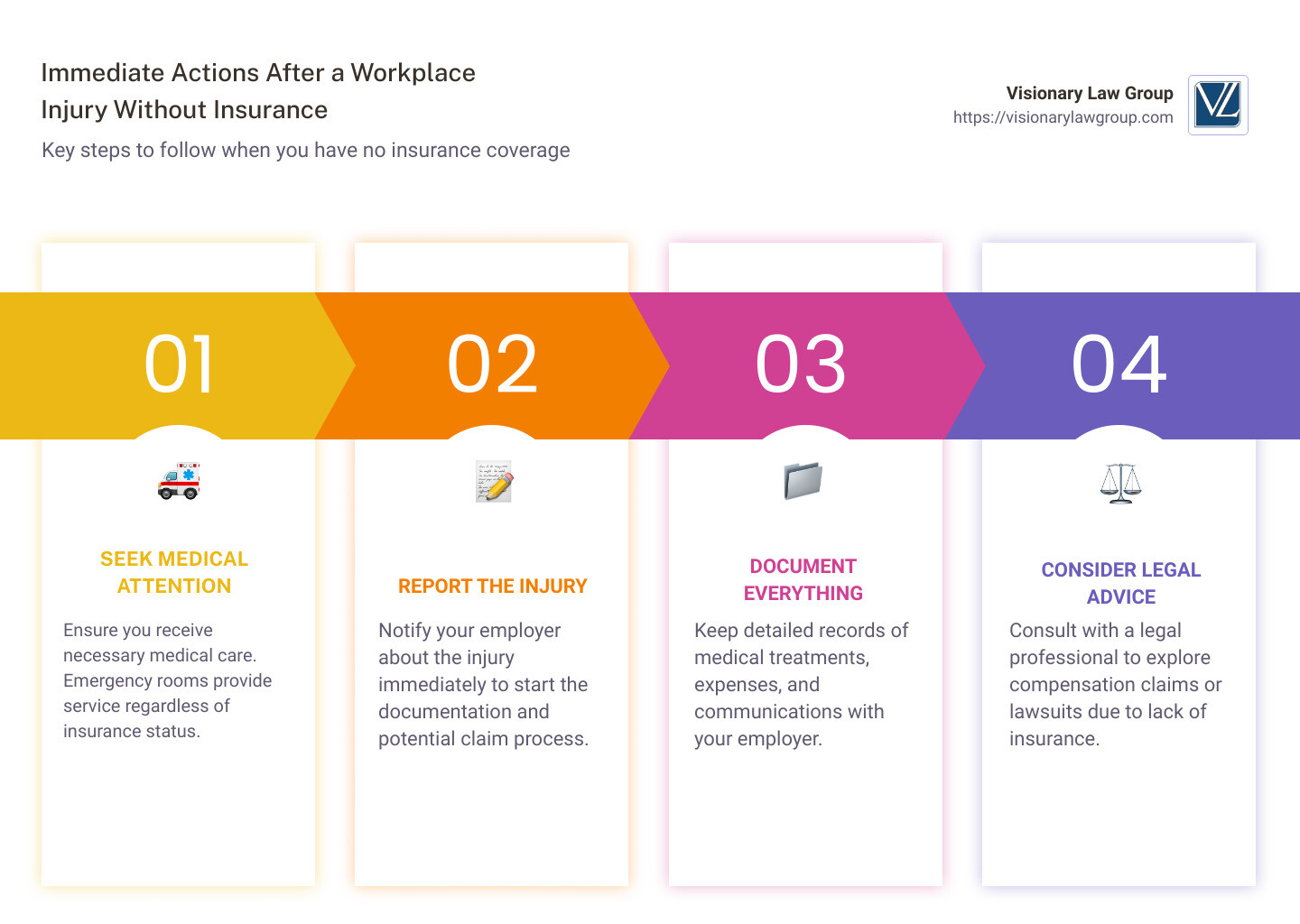

The primary steps you should consider immediately include:

– Seeking medical attention: Even without insurance, your health is the priority. Hospitals generally must provide care in emergency situations regardless of insurance.

– Reporting the injury to your employer: This step is crucial as it initiates any potential workers’ compensation claim and documentation process.

– Documenting everything: From medical records to details about the accident and conversations with your employer, keep everything recorded.

Knowing these initial actions can significantly influence the course of recovering your health and potential compensation.

Determining Your Coverage Status

When you’re injured on the job with no insurance, determining your coverage status is a critical first step. This involves understanding whether you might still be eligible for workers’ compensation, assessing employer liability, and considering any third-party liability.

Workers’ Compensation

First, verify if your employer is legally required to have workers’ compensation insurance. Most states mandate this insurance for businesses with more than a certain number of employees, though this number can vary. For instance, in Missouri, any employer with five or more employees must provide this coverage, and in the construction industry, even one employee necessitates coverage.

If your employer should have had workers’ compensation insurance but did not, they may face serious legal consequences, including fines or even criminal charges. More importantly for you, this failure does not leave you without options. States like Missouri allow you to potentially recover medical expenses through mechanisms like the Second Injury Fund if your employer is uninsured.

Employer Liability

Determining employer liability is crucial if there’s no workers’ compensation insurance. If your employer neglected their legal obligation to secure workers’ compensation, they might be directly liable for your injuries. This can open the door to a lawsuit where you can claim compensation for medical bills, lost wages, and possibly pain and suffering.

In cases where the employer has violated specific safety regulations leading to your injury, proving liability can be straightforward with the help of detailed incident documentation and legal expertise.

Third-Party Liability

Sometimes, a party other than your employer might be responsible for your injury. For example, if your injury was caused by faulty equipment, the manufacturer of that equipment could be liable. Identifying third-party liability involves examining the circumstances of your accident to see if another company or contractor’s negligence contributed to the event.

Exploring third-party claims can be complex, involving thorough investigations and sometimes technical assessments of equipment or environmental conditions. Legal professionals often work with experts in various fields to establish the extent of third-party liability.

Knowing your coverage status sets the foundation for navigating the aftermath of being injured on the job with no insurance. Whether it’s through workers’ compensation, direct employer liability, or third-party claims, understanding these aspects ensures you are better positioned to seek the compensation you deserve. Continue to the next section to learn exactly what steps to take immediately following your injury.

What to Do Immediately After Being Injured on the Job with No Insurance

When you’re injured on the job with no insurance, it’s crucial to act swiftly and smartly to protect your health and legal rights. Here are the immediate steps you should take:

Seek Medical Treatment

Your health is your top priority. If your injury is severe, call 911 or go directly to the nearest emergency room. For less critical injuries, still seek medical attention as soon as possible. Even if you’re worried about the costs, delaying treatment can worsen your condition, which might increase your medical expenses later on.

- Emergency Services: If it’s a severe injury, immediate medical care is necessary.

- Visit a Doctor: For non-emergency injuries, see a healthcare provider promptly to assess and document your injuries.

Report the Injury

Notify your employer about the injury as soon as you can, regardless of the insurance situation. Reporting the injury formally is not just a bureaucratic step; it’s essential for any future claims or legal actions you might need to take. This report should include:

- Time and place of the injury

- How the injury occurred

- Any witnesses present

This documentation is crucial as it establishes the work-related nature of the injury, which is vital for any legal claims or compensation processes.

Document Everything

Gather as much evidence as you can about the incident and your injuries. This includes:

- Photographs of the injury and the place where the injury occurred.

- Witness statements: If colleagues or others saw what happened, their accounts could be crucial.

- Medical records: Request copies of all medical reports and bills related to your injury. These documents are essential for medical and legal purposes.

Documenting these details might seem overwhelming, especially when you’re injured, but they are crucial for protecting your rights and options for compensation.

These immediate steps are critical in setting the stage for any necessary legal actions and ensuring that you can manage the financial implications of being injured at work without insurance. Continue to the next section to explore your legal options and how to navigate potential financial challenges.

Legal Options When Injured on the Job with No Insurance

When you’re injured on the job no insurance, it might feel like you’re out of options. However, there are several legal avenues you can pursue to seek the compensation you deserve. Let’s look at three main options: Personal Injury Lawsuit, Employer Liability, and Third-Party Claims.

Personal Injury Lawsuit

If your employer does not have workers’ compensation insurance, you may have the right to file a personal injury lawsuit against them. This is a significant shift from the workers’ comp system, which generally prohibits suing your employer for workplace injuries. In a personal injury lawsuit, you can seek full compensation for all your losses, including medical bills, lost wages, and even pain and suffering, which are not typically covered under workers’ comp.

Employer Liability

In cases where an employer is found liable for the injury, they can be responsible for covering all damages. This is particularly true in states where workers’ compensation is a legal requirement for most businesses. If an employer skips this obligation, they not only face legal penalties but are also exposed to lawsuits where they could be responsible for substantial compensatory payments to the injured employee.

Third-Party Claims

Sometimes, the cause of a workplace injury isn’t just about employer negligence but involves faulty equipment or actions by another company on the same worksite. In such scenarios, you might have a claim against third parties, such as equipment manufacturers or another contractor whose negligence contributed to your injury. These claims can provide additional compensation for aspects like ongoing pain and suffering, which go beyond what workers’ comp would offer.

Understanding these options is crucial, as each provides different benefits and involves distinct legal processes. Knowing which path aligns best with your situation can significantly impact the outcome of your case. Continue to the next section to learn about navigating financial challenges when you lack workers’ compensation coverage.

How to Navigate Financial Challenges Without Workers’ Compensation

When you’re injured on the job with no insurance, managing your financial responsibilities can feel overwhelming. Here are practical steps to tackle these challenges:

Disability Benefits

If your injury prevents you from working, you might qualify for disability benefits. These benefits are designed to replace a portion of your income. Here’s what you need to know:

– Short-term and Long-term: Benefits vary by duration; some cover a few months, while others extend for years.

– Application Process: You’ll need to provide medical documentation proving your inability to work.

– Where to Apply: Check with your state’s disability program or the Social Security Administration for eligibility criteria.

Unemployment Insurance

If you’ve recovered enough to work but your job is no longer available due to your injury, unemployment insurance might be an option. Here’s how it works:

– Eligibility: You must be ready and able to work and have been employed for a certain period before your injury.

– Benefits: These can help sustain you financially while you search for new employment.

– Application: File a claim through your state’s unemployment office.

Medical Cost Negotiation

Medical bills can pile up quickly after an injury. Here are strategies to manage them:

– Negotiate with Providers: Many hospitals have programs to reduce bills for uninsured patients. Don’t hesitate to ask about your options.

– Payment Plans: Request a payment plan that spreads out your bills over time, making them more manageable.

– Charity Care: Some hospitals offer charity care programs that can significantly reduce or even eliminate your medical expenses if you qualify.

Navigating these financial avenues requires understanding your rights and the available resources. Each option has its procedures and eligibility requirements, so it’s important to research thoroughly or seek professional advice. As you explore these financial solutions, you’re not alone in this journey.

Frequently Asked Questions about Workplace Injuries Without Insurance

What if my employer does not have workers’ compensation insurance?

If you find yourself injured on the job no insurance from your employer, it’s important to know that this might be against the law, depending on where you work. Most states require employers to carry workers’ compensation insurance. If your employer doesn’t have it, they can face severe penalties including fines and possibly criminal charges. For you, the injured worker, this means you might need to pursue a personal injury lawsuit to seek compensation for your injuries. It’s crucial to consult with a legal expert who can guide you through your options and help you understand your rights.

How can I cover my medical expenses after a workplace injury?

Covering medical expenses after an injury at work can seem overwhelming, especially without insurance. Here are some practical steps you can take:

- Workers’ Compensation Claim: Even if initial reports suggest there is no coverage, verify with your state’s workers’ compensation board. Sometimes, employers are legally covered even if they claim otherwise.

- Negotiate with Healthcare Providers: Explain your situation and ask for reduced rates or payment plans.

- State and Local Government Programs: Look for state disability programs or other local government assistance designed to help those with temporary or permanent disabilities.

- Charity Programs and Non-Profit Organizations: These organizations can sometimes offer financial assistance or direct you to resources that can help.

Can I sue my employer if I was injured and they don’t have insurance?

Yes, you can sue your employer if you were injured on the job and they do not have workers’ compensation insurance. This legal action can be complex, as it involves proving negligence on the part of your employer. It is important to gather as much evidence as possible related to your injury and the circumstances surrounding it. Consulting with a personal injury attorney who specializes in workplace injuries is crucial. They can help you navigate the legal system and work towards securing the compensation you deserve for medical costs, lost wages, and other damages.

Navigating these challenges without insurance can be daunting, but understanding your rights is the first step towards resolving these issues and securing your financial and physical recovery. Legal experts are available to help guide you through this process and ensure your rights are protected.

Conclusion

As we wrap up our guide on navigating workplace injuries without insurance, it’s crucial to focus on future precautions and how Visionary Law Group LLP can support you through this challenging time. When you find yourself injured on the job with no insurance, knowing your rights and the steps to take can make a significant difference in your recovery process.

Future Precautions

To prevent similar situations in the future, it’s essential to:

– Understand Your Rights: Always be aware of your rights as an employee, including what your employer’s responsibilities are towards workplace safety and insurance coverage.

– Communicate with Your Employer: Ensure that proper safety protocols are in place and that you are covered under the appropriate workers’ compensation plan.

– Stay Informed: Keep up-to-date with any changes in workplace safety laws and workers’ compensation regulations in your state.

Taking these steps can help safeguard your health and legal rights in the workplace.

Visionary Law Group LLP

At Visionary Law Group LLP, we understand the complexities involved when you’re injured on the job with no insurance. Our team is committed to providing robust legal support, ensuring that you understand your rights and exploring every avenue to secure the compensation you deserve. Whether it’s negotiating with insurance companies, handling legal proceedings, or providing personalized legal advice, our goal is to alleviate the stress associated with workplace injuries.

We tailor our strategies to meet the unique needs of each client, focusing on achieving the best possible outcomes while you concentrate on your recovery. Our expertise in workers’ compensation and personal injury law positions us as a formidable ally in your corner.

Take the First Step Towards Securing Your Future

Don’t navigate this challenging time alone. Visionary Law Group LLP is here to guide and support you. We invite you to schedule a free case evaluation with us. This no-obligation consultation will allow us to better understand your situation and provide you with detailed information on how we can assist you in securing your rights and your future.

Empower yourself with the right legal partner by your side. Contact us today for a free case evaluation and take the first step towards peace of mind and recovery.